Projects

Talks

Randomization Tests of Causal Effects Under General Interference

Salem Center Causal Inference Seminar - UT Austin (2022) / Society for Political Methodology Annual Meeting - NYU (2021) / International Indian Statistical Association (2021) / Arizona State University (2020) / The University of Chicago Booth School of Business - Econometrics and Statistics Seminar (2019) / Atlantic Causal Inference Conference - McGill University (2019) / International Conference on the Design of Experiments - University of Memphis (2019) / Society for Political Methodology Annual Meeting - MIT (2019) / Design and Analysis of Experiments - UT Knoxville (2019) / Advances with Field Experiments - Chicago Economics (2019)

Teaching

Quantitative Reasoning I and II (UATX)

Two-part sequence in the Intellectual Foundations program at The University of Austin.

Intro to Machine Learning

This is the second half of a two-part introductory course on predictive modeling for students in the MS program in Business Analytics at UT Austin. In the first half of the course, you learned about predictive models for labeled data (i.e. regression, or supervised learning). In the second half, we will turn to the following topics:

- a refresher of some important probability concepts.

- exploratory data analysis.

- resampling methods for uncertainty quantification.

- unsupervised learning, i.e. learning to model structure in unlabeled data.

The course is intended as an overview, rather than an in-depth treatment of any particular topic. We will move fast and cover a lot, but will focus on practical applications rather than theory.

- a refresher of some important probability concepts.

- exploratory data analysis.

- resampling methods for uncertainty quantification.

- unsupervised learning, i.e. learning to model structure in unlabeled data.

The course is intended as an overview, rather than an in-depth treatment of any particular topic. We will move fast and cover a lot, but will focus on practical applications rather than theory.

Policy Research Laboratory

The Policy Research Laboratory (PRL) is offered in the McCombs School of Business. Students will take a semester-long course in statistics, econometrics, and data science to learn the tools necessary for policy and social science research. In parallel, the students will apply these tools to real-world data and answer crucial policy questions. Policy research is important, and appropriately using data, cutting-edge statistical tools and remaining skeptical are equally important. Students can expect to leave this class with a deep understanding of policy questions and a toolbox for evaluating them.

After the semester, the research assistantship begins. Students will be matched with policy projects within the center and/or with faculty. They will have the opportunity to immediately use their skills learned in PRL to work on exciting research that culminates in journal submission and publication. The research projects will be high impact and could elucidate cause-and-effect and tradeoffs of policies being discussed in the global arena.

After the semester, the research assistantship begins. Students will be matched with policy projects within the center and/or with faculty. They will have the opportunity to immediately use their skills learned in PRL to work on exciting research that culminates in journal submission and publication. The research projects will be high impact and could elucidate cause-and-effect and tradeoffs of policies being discussed in the global arena.

Statistics for Executives

The core statistics course for the Executive MBA program at UT Austin.

Data Science for Economics & Policy

This is a semester-long course in statistics and data science to learn the tools necessary for policy, economics, and social science research. In parallel, students will apply these tools to real-world data and answer crucial policy questions.

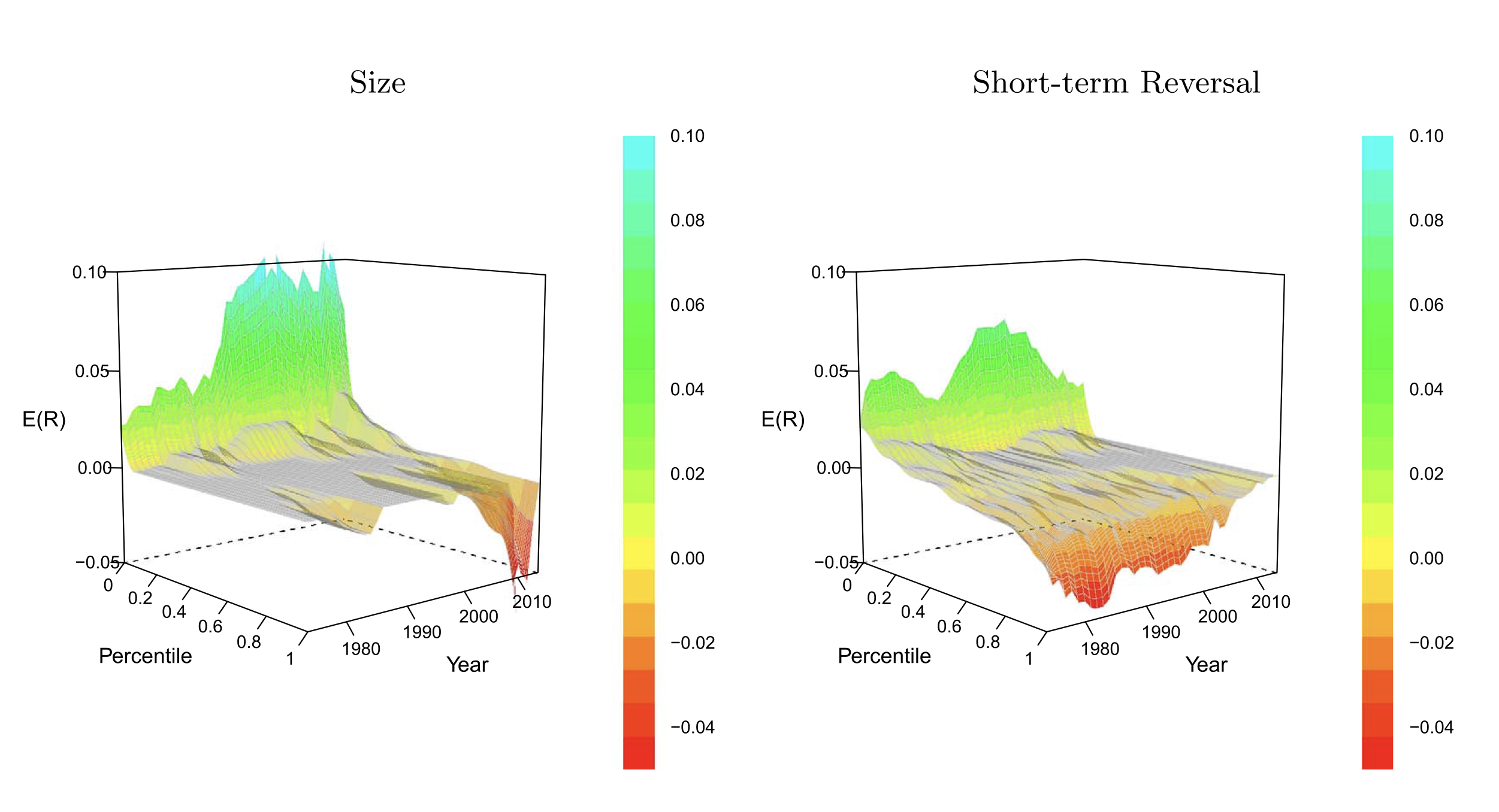

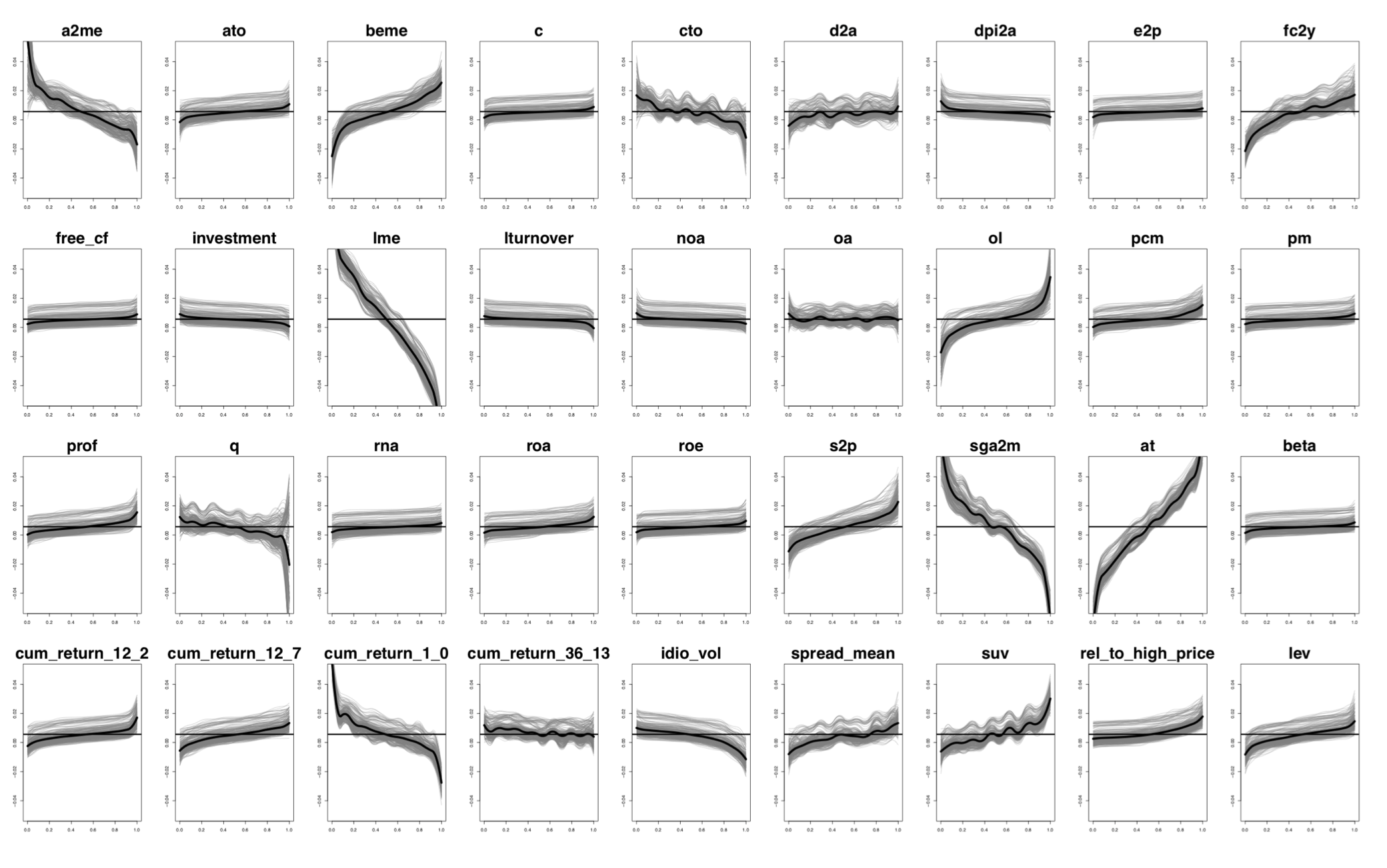

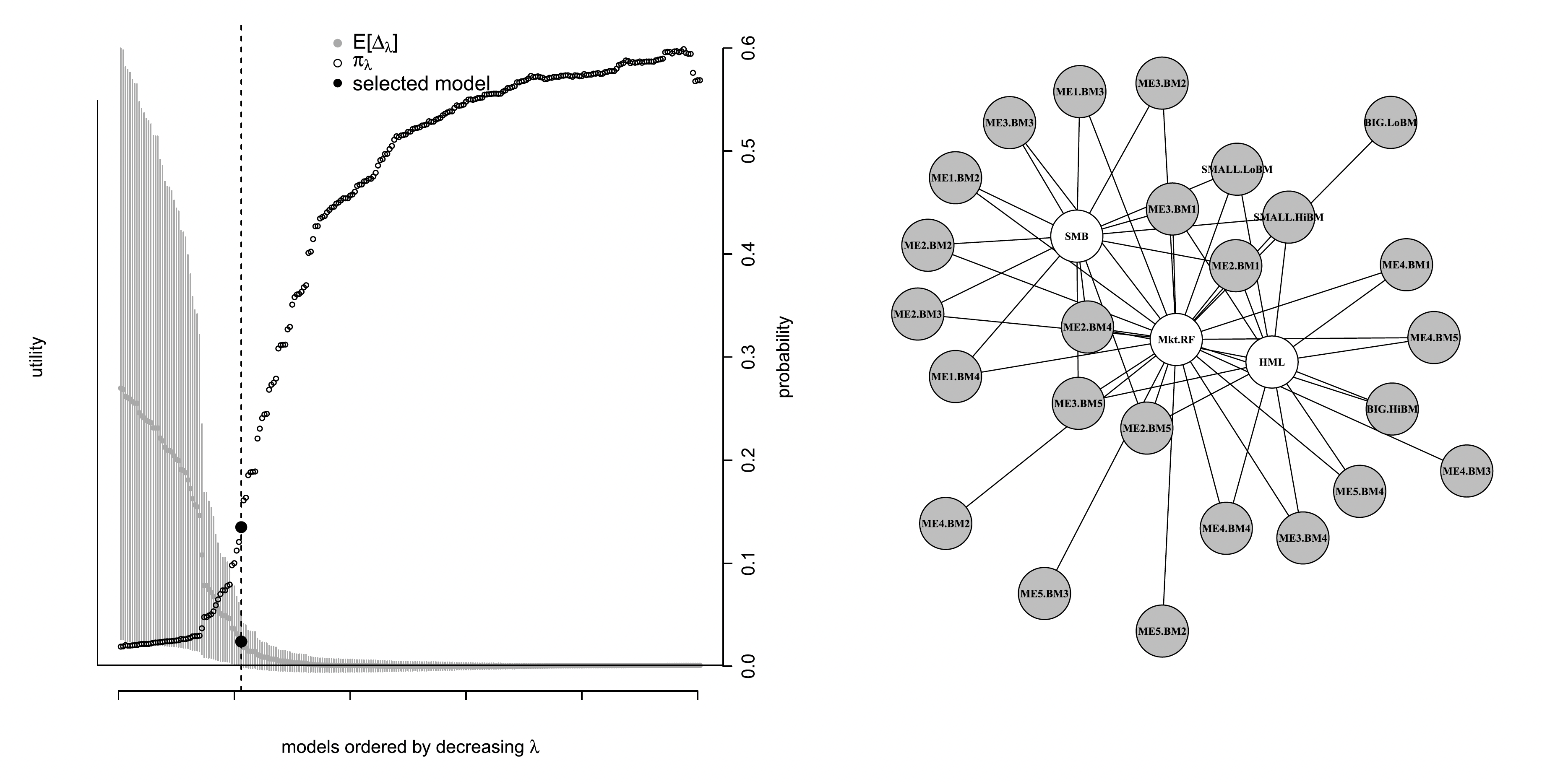

Machine Learning in Finance

PhD class at the University of Texas at Austin open to statistics, IROM, economics, and finance graduate students. Topics covered include modeling stock return panel data with supervised learning methods, navigating the bias-variance tradeoff with low signal-to-noise data, causal machine learning, and regularization-induced confounding. Here is the course website.